Adequate retirement income

Retiring planning can be very complex when you consider all of the different sources of possible retirement income and the uncertainty involved in investing. How can yo umake sure that you are on the right direction to financial stability in retirement?

What is an adequate retirement income?

A common goal for retirement is for a person to have enough income to enjoy the same standard of living as they had prior to retirement. Generally it is assumed that a person will need to have a retirement income equal to 70% of their pre-retirement income to accomplish this. The reason that a person can accept less income in retirement than during their working years is because they are assumed to have lower expenses. For example, in retirement it is assumed that the mortgage is paid off, there are no longer job related expenses such as commuting expenses, and there are no longer children living at home.

For example, if a person is earning $60,000 per year prior to retirement a common goal is to have a retirement income of $45,000. However, given your personal situation, your goal might be different.

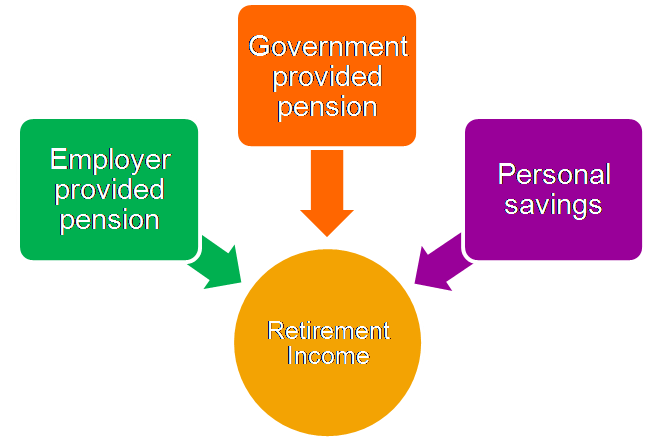

The three sources of retirement income

A person’s retirement income usually does not come from just one source. For most people in Canada there are three main sources: employer provided pensions, government provided pensions and personal savings. For most people, all three of these components are required to have an adequate retirement income.

Government provided pension programs

In Canada there are three components to the government provided pension; Canada Pension Plan (or Quebec Pension Plan), Old Age Security and the Guaranteed Income Supplement.

The Canada Pension Plan (CPP) is a mandatory pension plan for people employed in Canada (with a few small exceptions). While participating in the plan, employees and employers must make regular contributions. The CPP provides a retirement pension equal to approximately 25% of a person’s average earnings up to an annual cap called the Yearly Maximum Pensionable Earnings, or YMPE. For instance, for 2012 YMPE is set at $50,100. When a person’s average earnings are calculated, earnings in prior years are increased to reflect the fact that earning levels have risen. A 65 year old who has always worked and earned more than the YMPE would receive the maximum CPP retirement pension, which is a little more than $11,000 per year in 2010.

The Old Age Security (OAS) benefit provides a flat monthly pension starting at age 65. In 2012, the maximum OAS benefit is approximately $6,500 per year. The benefit is clawed back for high income earners. In 2012, the OAS benefit is reduced for anyone earning over $69,562.

For people whose earnings are less than the YMPE, their CPP benefit combined with their OAS benefit will provide a pension equal to approximately 35%-40% of their pre-retirement income. For higher income earners, this percentage will be much lower.

The Guaranteed Income Supplement provides a monthly non-taxable benefit to low-income Old Age Security recipients living in Canada.

If you would like to find out more information about the CPP, OAS or GIS you can contact us, or visit the Service Canada website which is listed on our links page.

Employer provided pension plans

There are many different types of employer provided pension plans, and plans can vary drastically on how much income they provide in retirement. Some pension plans are designed so that, when combined with the Canada Pension Plan benefit, they will provide a pension of approximately 60% of pre-retirement earnings for a person with 30 years of service. These plans are quite generous, with many employer provided plans providing much smaller pensions in retirement. It is not uncommon for plans, when combined with the Canada Pension Plan Benefit, to only provide a pension of 50% or less of pre-retirement earnings.

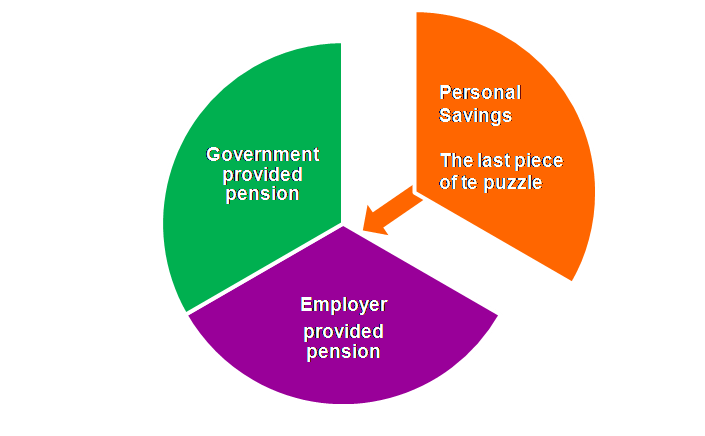

Personal savings

After taking into consideration government and employer provided pensions, personal savings is the last piece of the puzzle. The goal is to have enough personal savings to “top-up” retirement income to a desired level.

For example, assume that a person’s goal is to have a pension equal to 70% of pre-retirement earnings and their employer provided pension plan combined with their Canada Pension Plan benefit will provide a pension equal to 55%. In this case, the person must save enough each year to provide an additional pension equal to 15% of pre-retirement earnings (70% – 55%).

Personal savings can be invested in Registered Retirement Savings Plans (RRSPs) or in non-registered arrangements. The benefit of contributing to RRSPs is that any income contributed to RRSPs, and any investment income in the RRSP, is not considered taxable income. However, tax must be paid on money when it is withdrawn from an RRSP (i.e. in retirement).

In a non-registered arrangement, contributions must be made with after-tax income and all investment income is taxable. In this case, however, income in retirement is not considered taxable income.

As a result, it is usually a good idea to invest as much in RRSPs as possible so less income tax has to be paid. However, participation in an employer provided pension plan reduces RRSP room, possibly to zero if the pension is large enough. So it is possible that a person may require non-registered savings in order to meet their retirement needs.